The Pain Point: Why Payment Integrations Are Broken Today

Integrations with payment platforms are notoriously complex. For a merchant or PSP, connecting to acquirers, processors, or third-party APIs often takes months of effort, involving large teams and heavy custom engineering. By the time the integration is production-ready, market opportunities may already have shifted.

The result? Innovation slows down. Costs rise. Merchants are locked into rigid architectures that limit their ability to experiment with new payment experiences.

The AI Shift: Conversational, Context-Aware Interactions

At the same time, Generative AI has emerged as a force reshaping how systems and applications interact. Businesses are already leveraging AI to:

- Build smarter customer experiences

- Automate back-office processes

- Extract insights from unstructured data

- Enhance fraud monitoring and risk management

But when it comes to payments, integrating AI-driven solutions with PSPs and payment platforms is still a highly complex endeavor.

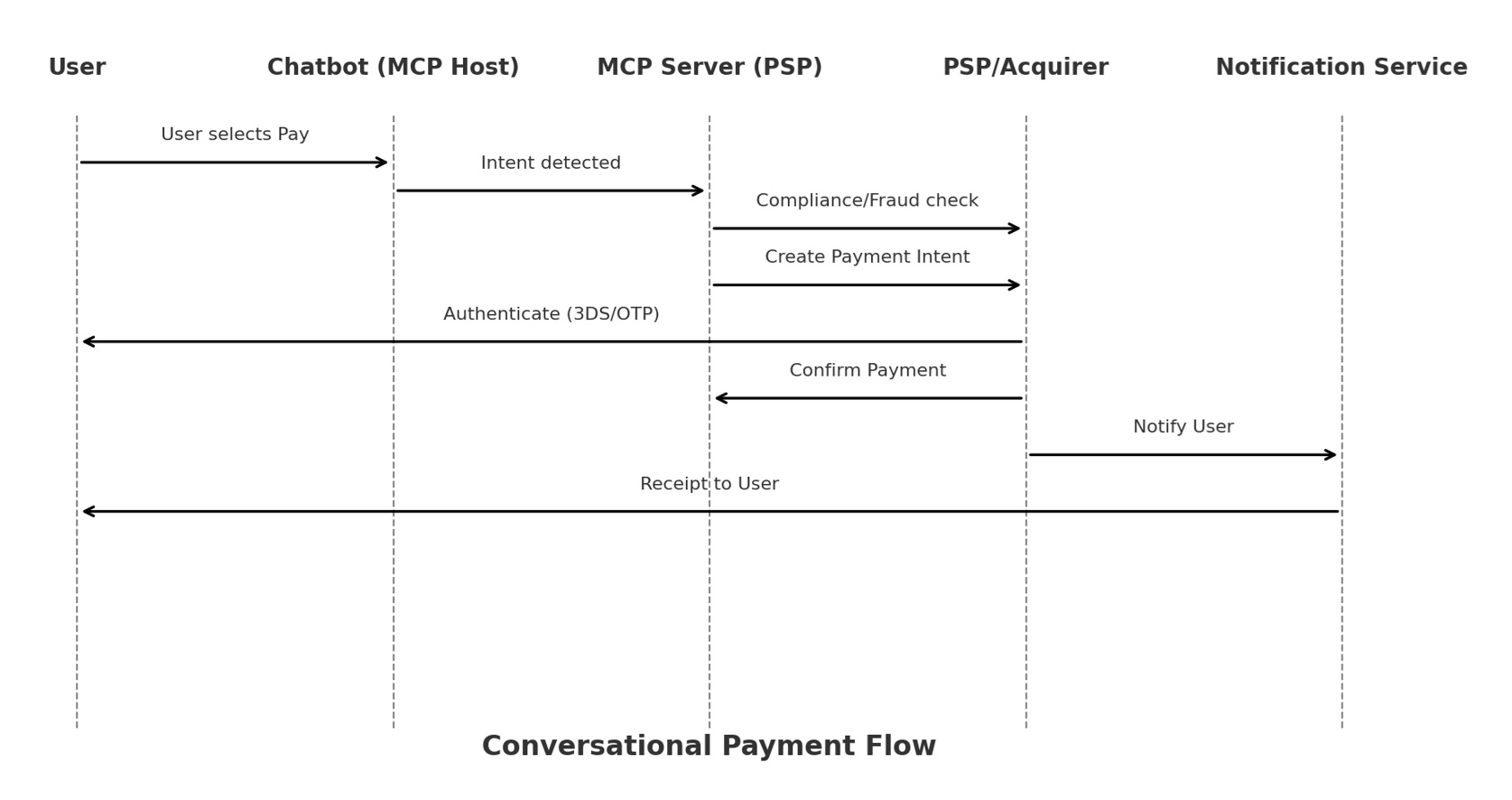

Imagine a merchant wanting to launch a chat-based payment flow where customers pay directly within a conversational interface. The idea sounds simple—but the integration work required today is anything but.

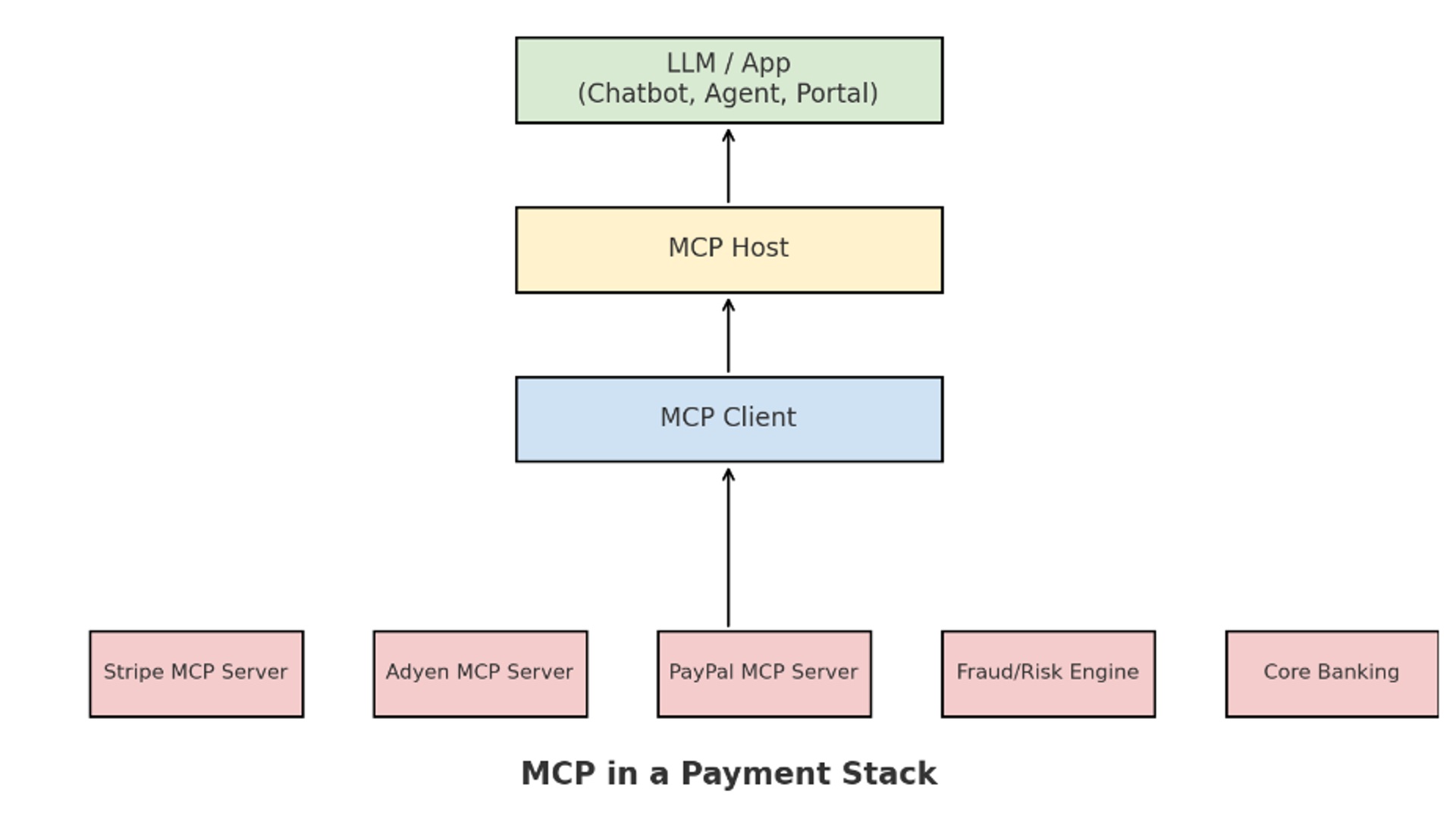

Enter MCP: A New Standard for Integration

This is where the Model Context Protocol (MCP) comes in. MCP is a new open standard that allows Large Language Models (LLMs) to seamlessly interact with external systems—like payment platforms—through a standardized interface. Unlike traditional integrations that depend on custom-built connectors, SDKs, and middleware, MCP enables:

- A plug-and-play approach to system integration

- Real-time, conversational interactions between LLMs and PSP APIs

- Faster time-to-market with less engineering overhead

At its core, MCP defines a common way for applications to expose capabilities and provide relevant context to AI models. For payments, this means that instead of reinventing integrations for each provider, developers can rely on MCP to orchestrate secure, standardized connections.

Why Payments is a Natural Fit for MCP

Payments is one of the most integration-heavy industries—making it the perfect ground for MCP adoption. Potential use cases include:

- Merchant onboarding: Automating KYC, account setup, and credential provisioning through natural language prompts.

- Dispute & chargeback automation: Enabling merchants or banks to trigger and track dispute workflows conversationally.

- Conversational payments: Allowing end-users to pay directly through chatbots, social commerce, or voice assistants.

- API harmonization: Normalizing fragmented PSP, acquirer, and bank APIs into a single AI- native layer.

- Risk & compliance workflows: Orchestrating fraud checks, AML triggers, and reporting via AI-driven requests.

Early Signs: Stripe, PayPal, Adyen Leaning In

This shift is already underway. Payment leaders are experimenting with MCP:

- Stripe has released its MCP server in public preview, with clear examples showing how tools like Claude Desktop can create customers, trigger payments, or manage subscriptions—all through natural language prompts.

- PayPal and Adyen have also begun exploring MCP-enabled servers, signaling that the next wave of payment APIs will be AI-native by design.

What once required weeks of integration and testing can now be executed in minutes of AI-driven orchestration.

The Future of Payment Integrations

The adoption of MCP represents more than just a new protocol—it represents a paradigm shift:

- From rigid APIs to flexible AI-native interactions

- From code-heavy integrations to natural language orchestration

- From months-long projects to rapid experimentation and scaling

For merchants, PSPs, and processors, this means:

- Lower costs of integration

- Faster go-to-market for new experiences

- Greater agility in adapting to customer expectation

Our Point of View: Why This Matters Now

In the next 2–3 years, MCP could cut payment integration timelines by 60–70%, dramatically lowering the barrier for merchants to adopt new payment methods or switch PSPs. Merchant technical teams may shift focus from coding APIs to orchestrating AI-native experiences.

Early adopters will define the next generation of payment experiences—and set new benchmarks for speed, simplicity, and customer delight.

For payment providers and merchants alike, the message is clear:

Don’t wait for MCP to “mature.” Start experimenting now.

Let’s Talk

Let’s experiment with MCP in payments—together.

Have a use case in mind (onboarding, disputes, conversational payments)?